Energy Star Certification & the 45L Tax Credit for Energy-Efficient Homes

The 45L tax credit, as outlined in Section 45L of the Internal Revenue Code, offers homebuilders incentives for constructing energy-efficient homes to reduce construction costs and is tied to Energy Star and Zero Energy Ready Homes certifications. While available for the past several years, these tax credits have now been enhanced by the Inflation Reduction Act of 2022 to provide greater benefits to homebuilders..

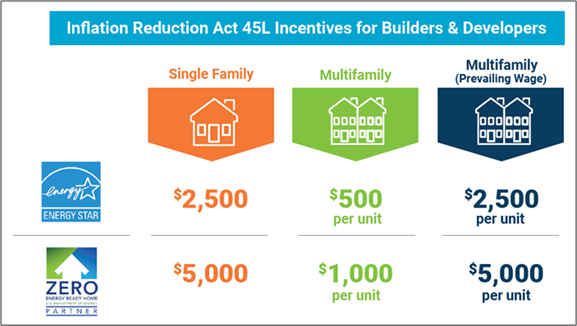

Key changes to the 45L tax credit in the Inflation Reduction Act include:

- The 45L tax credit has been approved for an extended period, until 12/31/32

- The tax credits are tied to Energy Star and Zero Energy Ready Home certifications.

- Tax credits have increased (see the infographic below)

When using the Energy Star certification to qualify for the 45L tax credit, homes sold by the homebuilder through the end of 2024 will need to meet the Energy Star requirements in effect when the permit was issued. Energy Star 3.2 will take effect in some locations for permits issued on or after 1/1/25. Energy Star version requirements vary by state, and can be confirmed here.

Single and multifamily homes need to be certified as meeting the Energy Star or Zero Ready Home standards to qualify for the 45L tax credit. Certification is required to be done by a Rater – a professional certified by an approved Home Certification Organization (HCCO) or Multifamily Review Organization (MRO). The Rater can also work with the homebuilder to identify and evaluate strategies to achieve Energy Star certification.

Energy Star defines a performance goal to be met rather than prescribing the method a builder must use to achieve certification. When working with the Rater, the homebuilder can evaluate different strategies for achieving Energy Star certification. Strategies can vary by the climate zone the house is located within, and some strategies will cost more than others. The Rater will also charge a fee to certify the home, and that cost should also be factored in when evaluating the total cost of achieving Energy Star certification and comparing it to the 45L tax credit to be received. Other additional energy efficiency incentives may also be available in certain states and locations.

Keep in mind as well that the 45L energy efficiency tax credit is governed by an Internal Revenue Service tax code. You can learn more here. Check with your tax consultant for tax advice and to fully ensure you are meeting the requirements of this tax code.

Updated 3.6-.24